Welcome to our comprehensive Best Credit Repair Software guide. Maintaining a healthy credit score is critical in today’s financial landscape for obtaining loans, mortgages, and lower interest rates. Credit repair software has emerged as an effective tool for gaining control of your credit profile.

Credit repair software is intended to assist you in cleaning up your own credit profile. There is no need to wait for someone else to do all of the work, as with credit repair services.

Credit repair software can also assist credit repair businesses with client and workload organization.

If you’re hesitant to take on DIY credit repair or wary of the risks and costs of hiring a credit repair company, consider using credit repair software. It’s a great middle ground that can offer you the help you need without the stress or high price tag.

In this comprehensive guide, we have compiled a list of the top 13 credit repair software options for your convenience. This will help you make an informed decision and choose the best option for your needs.

Individuals and businesses can use credit repair software to easily and quickly correct any errors on a report. We’ve selected the top 9 credit repair software solutions for both personal and professional use.

We’ve seen the best AI software for photo editing, generating images, marketing, recruiting, business, and sales in recent articles. Let’s take a look at some of the best credit repair software available today in this article:

What is Credit Repair Software & How Does it Work?

Credit repair software is a digital tool that can help people improve their credit scores. It works by analyzing your credit report, identifying negative items that may be lowering your score, and assisting you in dealing with them strategically. This software simplifies the credit repair process, making it more accessible to a wider range of people.

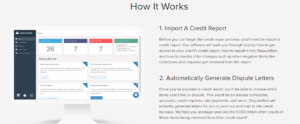

How It Works:

- Credit Report Analysis: Credit repair software first pulls your credit reports from major credit bureaus. It then scans these reports for errors, inaccuracies, and negative items that may be dragging down your credit score.

- Dispute Generation: The software generates dispute letters or challenges for the identified issues. These challenges are sent to the credit bureaus, creditors, and collection agencies responsible for the negative items.

- Tracking Progress: Credit repair software allows you to track the progress of your disputes. You can see which items have been successfully addressed and removed from your credit report.

- Educational Resources: Many credit repair software solutions offer educational resources to help you understand credit scoring, financial management, and credit-related laws.

It is critical to understand that credit repair software and credit repair services are not the same thing. Credit repair services are governed by the Credit Repair Organization Act (CROA) and provide dedicated one-on-one coaching and guidance.

What Is The Best Credit Repair Software?

Here are the best credit repair software options to consider in 2024:

- DisputeBee

- Credit Repair Cloud

- ScoreCEO

- Dovly

- Experian Boost

- The Personal Credit Builder

- Credit Versio

- TrackStar by HTDI

- DisputeSuite

1. DisputeBee

Best Overall Credit Repair Software

Clients can effectively communicate with credit bureaus, debt collection agencies, banks, lenders, and other furnishers by using DisputeBee to quickly and easily create dispute letters.

Importing a credit report before beginning the credit repair process is extremely simple—just a few mouse clicks.

You can see what information to dispute once the report is in DisputeBee.

Then, because the platform contains all of the information required for the notes, you can generate dispute letters.

Removing these incorrect items from your credit report will boost your credit score and allow you to qualify for lower-interest mortgages, loans, and credit.

FEATURES

- Automated dispute letter generation: DisputeBee helps you create professional and customized dispute letters based on your credit report and the items you want to challenge.

- Credit report import and monitoring: You can easily import your credit report from any of the three major credit bureaus: Equifax, Experian, and TransUnion, using DisputeBee.

- Client management and billing: If you own a credit repair company, DisputeBee can assist you in managing your clients and their disputes. You can create client profiles, assign tasks, send reminders, and communicate with them via email or SMS.

- Educational resources and support: DisputeBee provides you with access to educational materials and guides on how credit works and how to improve it.

Pros

- Easy to use and intuitive interface

- Affordable pricing plans for individuals and businesses

- Effective dispute strategies based on laws and regulations

- Comprehensive features for credit repair and business management

- Reliable customer service and satisfaction guarantee

Cons

- Requires manual printing and mailing of dispute letters

- Does not offer direct integration with credit bureaus or creditors

- It does not provide credit counseling or legal advice

Pricing

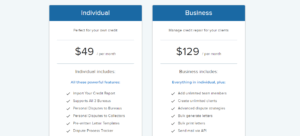

DisputeBee offers these pricing plans:

- Individual: $39 / per month

- Business: $99 / per month

DisputeBee is a powerful and easy-to-use credit repair software that can assist you in improving your credit score by disputing incorrect information on your credit report. It has a variety of features and advantages for both personal and professional use.

If you’re looking for a simple and cost-effective way to repair your credit or start a credit repair business, DisputeBee might be the right fit.

💡 Related guide: 13 Best Issue-Tracking Software

2. Credit Repair Cloud

Best for Educational Purposes.

Credit Repair Cloud is a robust software and training system that makes it simple for credit repair businesses to run and grow, or to add a completely fresh revenue source to an existing business.

It has helped thousands of people, a lot of whom still needed to gain debt settlement experience and establish successful businesses.

The system enables users to quickly raise their clients’ credit scores for approval of home, auto, or personal loans.

Credit Repair Cloud also offers an extensive range of tools that make it simple to launch a credit repair business from the ground up or add one as an additional service line.

The platform offers legally compliant services such as dispute automation and client management tools, in addition to training on how to run a successful credit repair business.

Credit Repair Cloud offers a client management system that enables credit repair companies to track client progress, manage caseloads, and communicate with clients.

These automated tools aid in the automation of routine tasks such as writing letters, filing disputes with various credit agencies, tracking progress for each client, report generation, and more.

The platform also includes integrations that allow users to access popular services such as QuickBooks Online, Google Calendar Sync, and Stripe payment integration.

FEATURES

Credit Report Importer:

- Imports credit reports from Equifax, Experian, and TransUnion with one click.

- Automatically analyzes reports to identify negative items for dispute.

Dispute Letter Generator:

- Offers compliant dispute letter templates under FCRA.

- Templates customizable to fit client preferences.

- Option to automate printing, mailing, emailing, or faxing of letters.

Client Portal:

- Secure and branded portal for each client.

- Clients can view credit reports, track progress, communicate, and make payments.

- Automated reminders and notifications enhance client engagement.

Business Dashboard:

- Provides an intuitive dashboard for business monitoring.

- Tracks client count, revenue, disputes sent, and items removed.

- Generates reports and charts for data visualization and trend analysis.

Affiliate Portal:

- Facilitates business growth through affiliate partnerships.

- Realtors, mortgage brokers, etc., can refer clients via a separate portal.

- Affiliates can submit leads, track commissions, and communicate.

Marketing Tools:

- Offers various marketing tools like landing pages, webinars, and more.

- Integration with platforms like Facebook, Google Ads, Mailchimp, Zapier.

- Supports business promotion through diverse channels.

These features collectively empower credit repair professionals to efficiently manage their clients’ credit repair journey, streamline communication, monitor business performance, foster affiliate collaborations, and effectively market their services.

Pros

- User-Friendly: Designed for easy use, no technical skills required.

- Scalability: Can accommodate businesses of any size, from small to large.

- Security: Data is encrypted, stored in the cloud, and backup options are available.

- Support: Offers strong customer support via multiple channels, plus a wealth of educational resources.

Cons

- Price: Relatively expensive compared to other options in the market.

- Limitations: Imposes limits on clients, disputes, team members, etc., with potential fees for exceeding limits.

- Learning Curve: Features and functions may require time and effort to fully grasp.

Pricing

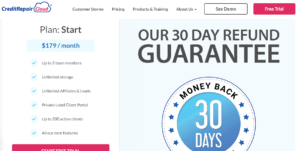

Credit Repair Cloud’s starter plan costs $179 per month.

3. ScoreCEO

Best For User-Friendliness.

ScoreCEO is popular due to its user-friendly interface, making it easy for beginners to use.

To use ScoreCEO effectively, you do not need any special training or skill sets.

ScoreCEO can also help businesses in the credit repair industry save time.

Automating many processes can improve overall service and save time/money.

They have more free time to innovate and evolve their business model instead of dealing with tedious administrative tasks.

ScoreCEO’s data security features are another significant advantage.

Businesses can use ScoreCEO’s advanced encryption technology to ensure that their customer data is secure while using its services.

FEATURES:

- Customer/Affiliate Portal: Personalized access to credit reports, dispute letters, contracts, invoices, communication, reminders, and updates.

- Analytics & Sales Workflow Pipeline Engines: Efficient lead and client management with customizable workflows, performance monitoring on a dashboard.

- Marketing & Contract Selection Automation: Automated marketing, landing pages, email campaigns, contract templates compliant with laws.

- Report Import: Imports credit reports from major bureaus, credit monitoring reports without manual data entry.

- Dispute Letter Compliance Engines: Creates FCRA-compliant dispute letters, customizable options, electronic or print delivery.

- Hellosign: Secure e-signature service for contracts, storage and management within ScoreCEO.

- Authorized.net: Accepts payments, recurring billing plans, refunds, transaction tracking.

- Mandrill: Sends emails, tracks email campaign performance using Mandrill service.

- Integrations: Compatible with various platforms including social media, analytics, communication, ecommerce, and more.

Pros

- Designed for credit repair businesses, covering essential features.

- User-friendly interface suitable for quick learning.

- Cloud-based accessibility from any internet-connected device.

- Secure and compliant with industry standards and regulations.

- Offers a free trial without requiring credit card information.

Cons

- Lacks a free plan or money-back guarantee.

- Limited customization for certain features like dispute letters and contracts.

- Does not support multi-language or multi-currency features.

Pricing

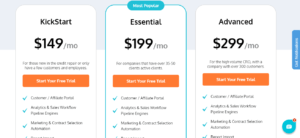

ScoreCEO offers three different plans with varying levels of features:

- KickStart: $129/month

- Essential: $179/month

- Advanced: $299/month

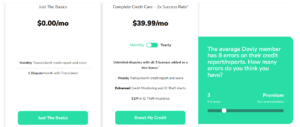

4. Dovly

Best For Credit Score Repair Automation.

Dovly takes credit monitoring to the next level by handling the entire process of enhancing and maintaining your credit score automatically.

Dovly’s algorithm quickly identifies credit report errors and misreported items.

It assists in correcting any inaccuracies or outdated information by sending disputes to Experian, Equifax, and TransUnion on your behalf.

Dovly will track the progress of each dispute once it is submitted.

It will then send you periodic updates so you can stay up to date on the status of your report.

Assume that something changes over time, such as late payments or identity theft concerns.

If necessary, the system will send new disputes to maintain accuracy.

This free service, with its automated system and proprietary dispute algorithm, can provide you with peace of mind by ensuring that all aspects of your credit report are addressed.

What is Dovly?

- Automated credit repair platform.

- Connects to your credit report, identifies negative items, and disputes them with credit bureaus.

- Monitors credit score and alerts for changes and potential identity theft.

- Claims 91% success rate and average score increase of 56 points in six months or less.

FEATURES:

- Offers both free and premium plans.

- Free plan includes monthly TransUnion® credit report, one dispute with TransUnion, basic monitoring.

- Premium plan costs $39.99/month, includes unlimited disputes with all three bureaus, weekly TransUnion® credit report, enhanced monitoring, $1 million ID theft insurance, live US-based support.

- Easy to use, minimal user input required.

- Fast, efficient, can dispute multiple items simultaneously.

- Affordable, transparent, no hidden fees, cancel or switch plans anytime, 14-day free trial for premium plan.

Pros

- Automated, handles credit dispute process.

- Effective with a high success rate.

- Comprehensive, covers all three credit bureaus, provides encryption and insurance.

Cons

- Can’t address legitimate negative items.

- Not a substitute for professional advice.

- Not available in all states, excludes Georgia and South Carolina.

Pricing

Dovly offers two plans:

- Free: $0.00

- Credit Maximizer: $8.33/month

Dovly is an excellent choice for anyone looking to improve their credit in a simple and cost-effective manner. It can assist you in identifying and disputing errors on your credit report, improving your credit score, and safeguarding your identity. It offers a free plan as well as a premium plan with additional features and benefits.

However, it is not a magic bullet that will solve all of your credit problems overnight. To maintain and improve your credit score, you must continue to be fiscally responsible and practice good credit habits.

💡 Related guide: 13 Best AI Tools for Students

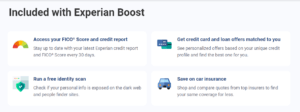

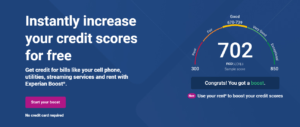

5. Experian Boost

Best For Boosting Your Experian Score.

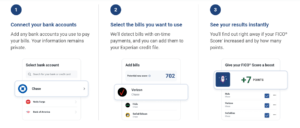

Experian has devised a method to instantly boost your FICO® Score when you make certain payments.

It evaluates your overall creditworthiness based on your payment history for utilities, rent, phone bills, and streaming services such as Netflix®, Hulu, Disney+, and HBO.

Experian has its own credit repair software called Experian Boost. By connecting to your financial accounts and reviewing your bills and payments, it helps improve your credit rating.

If you’ve been paying your utility bills and credit card bills on time, Boost will recognize these positive factors and immediately update your FICO.

Fortunately, the opposite is not true: if Boost discovers that you haven’t been making timely payments, it will not harm your credit score.

Using this simple tool can improve your credit score by 10 points on average, and those with fewer than five accounts on their credit report may see a 19 point increase – all for free.

Experian Boost is free and great for average or low credit scores and first-time credit users. High FICO score holders won’t see much benefit.

You will also receive points for each boost-eligible payment made within the last two years.

To take advantage of boost-eligible payment accounts, all you need to do is sign up with Experian and add them to your account. It’s that simple.

Once you add these accounts, they will contribute to the improvement of your FICO® Score each month.

FEATURES:

- Connects bank/credit card account to Experian credit report.

- Scans transactions for qualifying payments (3 payments in last 6 months, 1 in last 3 months).

- Qualifying payments include utility bills, phone bills, rent payments, and certain streaming services.

- Only considers positive payment history, doesn’t affect credit score negatively.

- Improves FICO® Score 3, 8, 9, 10, and VantageScore® 3 and 4.

- Free to use, includes free Experian membership with additional services.

Pros

- Easy to use, provides immediate credit score impact.

- Builds positive payment and credit history.

- Qualify for better rates, lower fees, higher limits.

- Secure, no sharing of bank/credit card information.

Cons

- Works only with Experian credit report, doesn’t affect Equifax or TransUnion reports.

- Doesn’t correct credit report errors.

- No guarantee of loan or credit card approval, other factors matter.

Pricing

It’s free to sign up for Experian Boost.

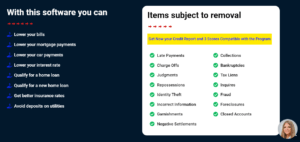

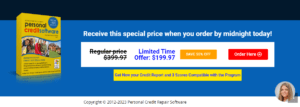

6. The Personal Credit Builder

Best For Dispute Templates.

Using Personal Credit Repair Software simplifies and streamlines the credit repair process by extracting derogatory items with one click and automatically assigning types, dispute letters, and reasons.

Our platform uses dispute letters and reasons to remove negative items from your credit report, ensuring accuracy and up-to-date information.

With the Personal Credit Repair Software, fixing your credit has never been simpler. Plus, there are some cool, extra features that make the process a breeze.

As an illustration, you can utilize templates to compose dispute letters that are customized to meet your precise requirements.

These templates are pre-loaded with state laws and regulations, so you don’t have to do any research.

FEATURES:

- Imports Equifax, Experian, and TransUnion credit reports with one click.

- Automatically identifies and handles negative items with dispute letters.

- Offers customizable dispute letters using templates and suggestions.

- Allows tracking of dispute progress and status.

- Provides educational resources for improving credit score.

Pros

- User-friendly interface, easy to use.

- Time and cost-effective by automating credit repair.

- Aims to increase credit score by removing inaccurate information.

- Offers a 30-day money-back guarantee for dissatisfaction.

Cons

- Requires a one-time payment of $199.97, which might be costly for some.

- Lacks customer support and software guidance.

- Cannot guarantee the success of all disputes or credit score improvement.

- Doesn’t include credit report monitoring for future errors or changes.

Pricing

The Personal Credit Builder costs $199.95 one time.

7. Credit Versio

Best for personal credit repair

Credit Versio is a credit repair and score improvement service that uses Artificial Intelligence to dispute accounts on all three bureaus simultaneously.

It helps you easily remove negative accounts from your credit report with our advanced system and dispute generation technology.

Their subscription plans include unlimited disputes, letter templates, and a personalized dispute strategy.

In addition, Credit Versio provides aid in safeguarding against identity theft and keeping track of any new credit report requests.

You can be assured that your information is safe and secure, and can only be accessed or altered with your permission.

The team of experts provides unlimited assistance throughout the entire process.

FEATURES:

- Smart Import: Imports and analyzes 3 bureau credit report, identifies negative accounts for dispute.

- Disputes that Work: AI-powered dispute strategies tailored to different negative accounts.

- Unlimited Disputes: Can dispute multiple accounts on all 3 bureaus simultaneously.

- Track Your Results: Monitors dispute progress, provides monthly progress report and updated credit scores.

- Video Coaching Course: Credit experts offer video coaching, answering questions about credit improvement.

Pros

- Free Software: Credit Versio is free, requiring payment only for 3 bureau credit report subscription and postage.

- Easy to Use: User-friendly and intuitive, automates credit report analysis and dispute creation.

- Effective Disputes: Creates powerful and personalized disputes for better results.

- Fast Results: Users report improvements within 30 days.

Cons

- No Business Subscription: Designed for individuals, lacks options for credit repair professionals.

- Absence of Mobile App: Accessible only through web browsers, lacks mobile app.

- No Money-Back Guarantee: No trial or refund policy for the credit report subscription.

Pricing

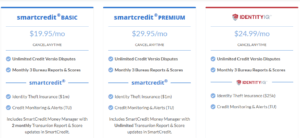

Credit Versio offers these pricing plans:

- smartcredit®BASIC: $19.95/month

- smartcredit®PREMIUM: $24.95/month

- Identity IQ: $29.99/month

Credit Versio is credit repair software that can assist you in improving your credit and raising your score. It is free, simple to use, smart, and effective.

It can assist you in disputing any negative account with all three bureaus and tracking your progress.

Credit Versio also offers video coaching from credit experts.

However, it is not suitable for businesses or credit repair professionals. It also does not have a mobile app or a money-back guarantee.

Credit Versio may be a good option for you if you are looking for a simple and affordable way to repair your own credit. Sign up for the software at Credit Versio to start improving your credit right away.

Get Started With Credit Versio

💡 Related guide: 11 Best AI Marketing Tools to Automate your Business

8. TrackStar

TrackStar Software is safe, reliable, and quick. Many automated tools help clients avoid the tedium of credit repair. Auto-scheduling, auto-notifications, and auto-suggest record search all contribute to faster results.

This software can simply create a dispute letter in just 10 seconds, reducing busy work. Trackstar streamlines dispute management by using a proactive strategy.

TrackStar protects your data (your customers’ sensitive confidential info) from getting into the wrong hands by using completely isolated databases. Many system integrates your data with that of your competitors in the same database! It comes with a full sales commission tracking system, making it simple to increase revenue through affiliates, brokers, and your own in-house sales team.

TrackStar is the most efficient credit repair tracking system on the market thanks to a slew of automation features built right in. Auto-scheduling, auto-notifications, as well as other automatically generated triggers let you spend up to 80% less time on customer support and other tedious tasks and more time on the things that make you money.

FEATURES:

TrackStar’s standout features include:

- Security: Your data and clients’ sensitive info are safeguarded in completely isolated databases, ensuring no data mix-ups with competitors.

- Sales Focus: It boasts a comprehensive sales commission tracking system, perfect for building your business through affiliates, brokers, or in-house teams.

- Efficiency: TrackStar leads the credit repair tracking market with automation features such as task scheduling, client and staff notifications, and dispute record suggestions.

- Speed: TrackStar is the fastest credit repair tracking solution, enabling quick data entry, dispute letter generation in under 10 seconds, and responses within as little as one day with digital disputing.

- Expertise: Gain access to a personal credit repair guru for expert knowledge and advice on becoming a credit repair pro.

- Proactive: TrackStar aids in prompt collection from delinquent clients by tracking non-responsive clients and initiating contact.

Pros

- User-Friendly: Its intuitive interface simplifies navigation, offering easy access to all features from a single dashboard.

- Customization: Tailor the software to your liking, creating templates, logos, letters, emails, reports, and more.

- Scalability: Handle any client volume and data without compromising speed or performance. Add unlimited users, affiliates, brokers, and staff.

- Affordability: A flexible pricing plan based on company volume means you only pay for what you use, with no hidden fees or contracts.

Cons

- Limited Support: Expect no 24/7 customer support or live chat, only phone or email assistance during business hours.

- No Mobile App: There’s no mobile app; access is solely through a web browser on your computer.

- No Free Trial: TrackStar lacks a free trial or money-back guarantee, requiring upfront payment without a trial run.

TrackStar by HTDI is a potent credit repair software that can boost your business and enhance client credit scores. With its numerous features and benefits, it’s among the best credit repair software options available. However, it’s not without limitations. We recommend carefully weighing the pros and cons before making a decision.

💡 Related guide: Best Transcription Software & Services to convert audio/video to text

The multi-user software in Dispute Suite gives your company full access to each customer’s file. The web-based system offers immediate access to check a status, write notes, or upload files.

Dispute Suite Platinum simplifies dispute resolution by enabling collaboration at a low cost. All customer information is in one place, easily accessible and understandable.

DisputeSuite is a multi-user software that provides a complete overview of each of your clients to your entire organization. This lets you maintain records of every customer and lead, allowing for cross-company collaboration.

At the Credit Repair Boot Camp, experts team up to share their highly classified methods, tricks, and strategies! If you currently run a credit repair business or are considering starting one, the information taught at the Boot Camp conference will be invaluable to you.

Discover about credit repair strategies, marketing, business development, sales, and leadership, among other topics. At no additional cost, you can add an unlimited number of affiliates, clients, and leads.

If you’re on the hunt for the ultimate credit repair software to launch and manage your credit repair venture, DisputeSuite is a promising contender. This web-based application offers a comprehensive suite of tools and features to streamline your credit repair processes.

FEATURES:

- Robust Lead, Customer, and Affiliate Management: DisputeSuite empowers you to effortlessly handle an unlimited number of leads, customers, and affiliates. You can monitor each customer’s progress, collaborate with your team, and even link records for joint customers, like spouses or partners.

- Customer and Affiliate Portal: Offering secure access, DisputeSuite furnishes your customers and affiliates with a portal to view credit reports, track disputes, communicate with you, and refer new leads. Personalize the portal with your branding and logo.

- Credit Reports Integration: Seamlessly integrate with major credit bureaus and report providers to import and analyze your customers’ credit reports. Store and manage multiple credit reports for each customer within the software.

- Dispute Automation and Management: Simplify the dispute process with automated dispute letter generation for credit bureaus, creditors, and collection agencies. Choose from a library of pre-written dispute letters or craft your own custom versions. Keep track of dispute status and results, and generate dispute reports for your clients.

- Letter Editor and Library: Customize dispute letters using an intuitive editor and access a library of over 200 dispute letters for various scenarios. Create your own templates for future use.

- Billing System: Set up and manage billing plans and invoices for your clients. Opt for different billing models, like pay-per-delete, monthly subscriptions, or flat fees.

- Administration Control: Enjoy complete control over software settings and preferences, from company information and logo to email templates, security roles, permissions, notifications, alerts, and more.

- Web-Based Accessibility: DisputeSuite is a web-based solution, eliminating the need for installations or downloads. Access it from any web browser, anywhere in the world, and enable telecommuting and remote work options for your team.

- Security: Rest assured with SSL encryption and firewall protection to safeguard your data. DisputeSuite also complies with the Credit Repair Organizations Act (CROA) and industry standards.

Pros

- User-Friendly: You don’t need prior credit repair experience; it’s easy to use for beginners.

- Comprehensive Solution: Provides a holistic solution for managing all aspects of credit repair business.

- Free Trial and Money-Back Guarantee: Offers a risk-free trial and a money-back guarantee.

- Responsive Customer Support: Boasts a helpful and responsive customer support team.

- Positive Reviews: Garners positive reviews and testimonials from satisfied users.

Cons

- Costlier Option: Pricier compared to some other credit repair software alternatives.

- No Mobile App: Lacks a dedicated mobile app and native integration with QuickBooks.

- No Training or Certification: Doesn’t offer training or certification programs for credit repair professionals.

Pricing:

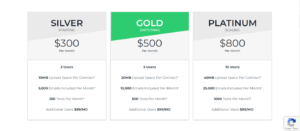

DisputeSuite offers three pricing plans:

- SILVER: $300/month

- GOLD: $500/month

- PLATINUM: $800/month

DisputeSuite emerges as one of the top contenders in the credit repair software market. With its rich feature set, it streamlines and automates credit repair processes, while offering a user-friendly interface and dependable customer support.

However, it comes at a higher cost and lacks a few features that some users might find essential. To make an informed decision, we recommend taking advantage of the free trial to assess its suitability for your needs and budget.

💡 Related guide: Best AI Website Builder Options for creating professional websites quickly

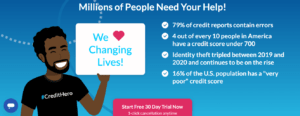

Can Credit Repair Software Really Improve My Credit Score?

Absolutely, credit repair software can help you improve your credit score. It is important to note, however, that credit repair is not a quick fix, and results will vary depending on individual circumstances.

Benefits of Credit Repair Software:

- Error Correction: If your credit report contains errors, disputing them through credit repair software can lead to their removal, potentially boosting your score.

- Negative Item Resolution: Credit repair software can help you address negative items like late payments, collections, and charge-offs, which can lead to score improvement.

- Credit Education: Gain insights into how credit scores work and learn strategies for better financial management.

- Efficiency: Credit repair software automates the credit dispute process, saving you time and effort.

- Accuracy: These tools can pinpoint inaccuracies in your credit report that may be hurting your score.

- Education: Credit repair software often comes with educational resources to help you understand credit better.

- Customization: Good software adapts to your specific credit situation, providing personalized recommendations.

Key Features to Look For in Credit Repair Software

When choosing credit repair software, it’s crucial to consider the features it offers:

- Credit Report Retrieval: Look for software that can easily retrieve your credit reports from major bureaus.

- Dispute Letter Customization: The software should allow you to customize dispute letters to address specific issues.

- Progress Tracking: Choose software with a dashboard that shows the status of your disputes and improvements.

- Credit Education Resources: Access to educational content that empowers you to make informed credit decisions.

- Customer Support: Reliable customer support can assist you throughout your credit repair journey.

- Security: Ensure the software follows strict security protocols to protect your sensitive information.

These features contribute to the effectiveness of credit repair software in achieving better credit scores.

💡 Related guide: 13+ Best Web Hosting Services for 2023 (Top Providers Ranked)

Easy-to-use Credit Repair Software for Beginners

If you’re new to credit repair and looking for user-friendly software, Credit Versio is an excellent choice. Designed to simplify the process, it helps you boost your credit score by creating custom dispute letters and tracking your progress.

Below are the standout features and benefits of Credit Versio:

1. No Credit Card Required

- Access All Three Bureaus: Credit Versio offers a hassle-free sign-up with no need for a credit card. You can access your credit reports and scores from all three major bureaus.

- Identify Negative Items: Easily pinpoint the negative items affecting your credit, along with their associated interest rates and fees.

2. Personalized Dispute Letters

- Tailored to Your Situation: Credit Versio generates dispute letters tailored to your unique credit situation and specific errors you want to dispute.

- Edit and Send: Customize these letters to your preferences, whether you want to print them or send them digitally.

- Addresses and Mailing Tips: It provides the necessary addresses for credit bureaus and creditors, along with valuable tips for effective mailing.

3. Track Your Progress

- Continuous Monitoring: The software keeps an eye on your credit reports and scores, promptly notifying you of any changes or updates.

- Visualize Improvement: Track your credit score’s progress over time, and see the money you’ll save with a better credit rating.

4. Educational Resources

- Learn and Grow: Credit Versio offers a wealth of educational resources, including articles, videos, and guides.

- Topics Covered: You can explore credit repair basics, best practices for disputing errors, consumer rights and responsibilities, and more.

Because of its simplicity, affordability, and effectiveness, Credit Versio stands out as one of the best credit repair software options for beginners. Begin your credit repair journey today with a risk-free trial to see the results for yourself. Visit Credit Versio’s website or read customer reviews for more information.

Affordable Credit Repair Software with Proven Results

Benefits of Affordable Credit Repair Software

- Access Credit Reports: Affordable credit repair software enables users to access credit reports from major credit bureaus, including Equifax, Experian, and TransUnion.

- Error Identification: Users can identify and dispute errors, inaccuracies, or negative items on their credit reports that negatively impact their credit scores.

- Dispute Generation: The software facilitates the generation and submission of dispute letters or online forms to credit bureaus or creditors.

- Progress Tracking: Users can monitor the progress and outcomes of their disputes with credit bureaus or creditors.

- Credit Monitoring: The software offers credit score monitoring and provides tips on improving credit scores.

Credit repair software is a valuable tool for enhancing your credit score by addressing errors and negative items on your credit reports. However, not all credit repair software is equal. Some are costly, complex, or ineffective. If you’re searching for top-tier credit repair software that’s budget-friendly, user-friendly, and proven to deliver results, look no further than Credit Repair Cloud.

Why Credit Repair Cloud Stands Out

Credit Repair Cloud sets itself apart as the best credit repair software on the market, offering an array of features that make credit repair more accessible and effective:

1. Automated Dispute Letters

- Effortless Letter Generation: Craft professional, personalized dispute letters in mere clicks.

- Auto-Fill Functionality: The software auto-populates your personal info, error details, and legal reasons for disputes.

- Template Variety: Choose from hundreds of templates and tailor them to your preferences.

2. Credit Report Import

- Seamless Import: Easily import credit reports from Equifax, Experian, and TransUnion.

- Error Identification: The software analyzes your reports, pinpointing detrimental errors and negative items impacting your score.

3. Credit Score Tracker

- Track Your Progress: Monitor your credit score’s journey and observe improvements over time.

- Insightful Analysis: Gain insights into the factors influencing your score and receive actionable tips for improvement.

4. Client Portal

- Secure Client Access: If you run a credit repair business, provide clients with a secure, branded portal.

- Access Resources: Clients can access their credit reports, dispute letters, and progress updates.

- Effective Communication: Communicate with clients through the portal and send invoices and reminders.

5. Business Tools

- Streamlined Business Management: Manage your credit repair business effortlessly with the software’s business tools.

- Website Creation: Build a professional website.

- Lead Generation: Generate leads to expand your client base.

- Team Management: Efficiently manage your team.

- Payment Plans: Set up payment plans and more.

Affordable and Free Trial

- Cost-Effective: Credit Repair Cloud is budget-friendly, ensuring accessibility for all.

- 30-Day Free Trial: Test all features during a 30-day free trial period.

- Community Support: Join a community of over 25,000 credit repair professionals and tap into expert support and advice.

Whether you aim to boost your personal credit score or launch your own credit repair business, Credit Repair Cloud emerges as the best credit repair software. Its affordability, user-friendliness, and proven track record make it a standout choice. Don’t let poor credit impede your financial goals—experience the difference with Credit Repair Cloud today!

💡 Related guide: 11+ Best Landing Page Builders for 2023 (Top Picks Ranked)

Credit Repair Software with Free Trial

A free trial option for credit repair software allows users to test its features and benefits before making a purchase or subscription. This method assists individuals in assessing the efficiency and suitability of software for their specific needs, potentially saving both time and money.

Examples of Credit Repair Software with Free Trial:

-

Credit Repair Cloud:

- A cloud-based software designed for credit repair businesses.

- Offers client management, credit report import, dispute letter creation, result monitoring, and reporting.

- Provides a credit repair certification program and a 30-day money-back guarantee.

- Subscription price starts at $179 per month, with a 30-day free trial.

-

SmartCredit:

- A web-based platform offering comprehensive credit repair management.

- Allows access to credit reports, credit score analysis, dispute letter generation, and progress tracking.

- Provides a personalized 120-day action plan for credit score improvement.

- Subscription plan available at $29.95 per month, with a 14-day free trial.

-

TurboDispute:

- A cloud-based software for credit repair businesses.

- Offers automated dispute letters, client and affiliate portals, and full customization.

- Subscription plans start from $99 per month, with a 30-day free trial.

Individuals looking to repair their credit reports and improve their credit scores can benefit from credit repair software with a free trial option. To achieve their financial goals and enjoy the benefits of good credit, users should conduct thorough research, maintain realistic expectations, and adhere to established credit repair best practices.

Best Credit Repair Software for Fast Results

Finding the right credit repair software can be a cost-effective solution if you want to rapidly improve your credit score. When compared to professional services, these tools can assist you in recognizing and dispute errors, inaccuracies, or negative items on your credit reports, potentially saving you time and money.

Credit repair software varies in terms of effectiveness, user-friendliness, affordability, features, support, and guarantees.

Choosing the best credit repair software involves considering factors such as features, pricing, user reviews, and ratings.

Recommended Credit Repair Software for Fast Results

-

Credit Repair Magic:

- Downloadable software with step-by-step instructions and video tutorials.

- Offers automated dispute letters for quick credit report improvement.

- Provides a 60-day money-back guarantee and lifetime updates.

- Price: $97 (one-time fee).

-

Dovly:

- A web-based platform that automates disputes with major credit bureaus.

- Monitors credit scores and offers credit improvement tips.

- Claims an average increase of 69 points in six months or less for 92% of clients.

- Offers both a free plan and a premium plan for $49.99 per month.

-

SmartCredit:

- A web-based platform for comprehensive credit repair management.

- Allows access to credit reports, credit score analysis, dispute letter generation, and progress tracking.

- Provides a personalized 120-day game plan for credit improvement.

- Offers a free trial and a subscription plan for $29.95 per month.

-

Credit-Aid:

- Downloadable software compatible with Mac and Windows.

- Assists in accessing credit reports, credit score analysis, dispute letter generation, and progress tracking.

- Comes with a 30-day money-back guarantee and free customer support.

- Price: $39.95 (one-time fee).

Credit repair software is an invaluable resource for those looking to quickly improve their credit reports and credit scores. To achieve their financial goals and reap the benefits of a strong credit profile, users should conduct their own research, maintain realistic expectations, and adhere to established credit repair best practices.

Top-rated Credit Repair Software for disputing inaccuracies

When it comes to repairing your credit and improving your financial health, choosing the right credit repair software is essential. With numerous options available, it can be overwhelming. We’ve reviewed the top-rated credit repair software products based on features, pricing, customer reviews, and reputation to help you make an informed choice.

Here are our picks for the best credit repair software in 2024:

1. Dovly: Best for Filing Disputes

- Automated Dispute Processing: Dovly offers fully automated credit repair, helping you dispute errors with all major credit bureaus.

- Advanced Algorithm: Identifies and challenges inaccuracies such as late payments, collections, charge-offs, and bankruptcies.

- Progress Tracking: Monitors your dispute progress and provides monthly credit score updates.

- Pricing: Free sign-up with access to credit score and report summary. Premium plan at $49.99 per month.

2. SmartCredit: Best Overall

- Comprehensive Credit Management: SmartCredit goes beyond repair, offering a holistic credit management platform.

- Actionable Insights: ScoreBuilder provides personalized action buttons for negative items on your credit report.

- ScoreBoost: Simulate how different actions impact your credit score.

- Educational Resources: Access tools, tips, and resources to optimize your credit.

- Pricing: Free 14-day trial, $29.95 per month.

3. Credit Repair Cloud: Best for New Businesses

- Start Your Credit Repair Business: Cloud-based software for running a successful credit repair business.

- Complete Business Solutions: Generate dispute letters, manage clients, track results, and receive payments.

- Training and Support: Offers training, support, and marketing tools for business growth.

- Pricing: Free trial, plans ranging from $179 to $599 per month.

4. Credit Detailer: Best for Established Businesses

- Streamlined Workflow: Desktop software for handling unlimited clients and disputes.

- Import Credit Reports: Create dispute letters, track progress, generate reports, and communicate with clients.

- Bilingual Support: Spanish-English interface and documents.

- Pricing: One-time fee of $399 or $799 depending on the version.

5. Credit Versio: Best Budget Option

- Affordable Credit Repair: A cost-effective online software for disputing credit report errors.

- Simple Process: Upload credit reports, select items to dispute, and download dispute letters.

- Credit Monitoring: Keeps an eye on your credit score and sends alerts for changes.

- Pricing: Free 7-day trial, $19.95 per month.

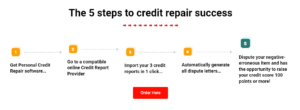

Steps to Boost Your Credit Score Using Software

Step 1: Setting Up Your Profile and Accounts

Start by creating a profile and linking your credit accounts to the software.

Step 2: Analyzing Your Credit Report

Allow the software to analyze your credit report for inaccuracies and negative items.

Step 3: Identifying Negative Items

Review the identified negative items and decide which ones to dispute.

Step 4: Creating Dispute Letters

Use the software’s tools to generate dispute letters and track their progress.

Step 5: Monitoring Your Progress

Regularly check your credit score and track improvements using the software’s monitoring features.

💡 Related guide: 13+ Best Ecommerce Platforms of 2023: Dominate the Online Market like a Pro!

Is Credit Repair Software Suitable for Both Individuals and Businesses?

Yes, credit repair software can help both individuals and businesses improve their credit health.

Individuals: Individuals with poor credit scores can benefit from credit repair software to remove errors and address negative items.

Businesses: Small businesses and entrepreneurs seeking loans or financing can enhance their credit profiles using credit repair software.

Remember that the software’s effectiveness is dependent on the accuracy of the information you provide as well as the complexity of your credit issues.

Wrap-up

You will be able to restore your credit in due time if you follow all of the tips above. You’ll be able to qualify for top low-interest personal loans with better credit and keep more money in your wallet.

Avoid being reckoned with high-interest rates by taking responsible steps to repair your credit. You’ll be glad you did once you start seeing results.

Individuals seeking to improve their credit scores by identifying and resolving errors on their credit reports may find credit repair software useful.

When choosing credit repair software, important factors include education, dispute resolution, identity theft protection, credit report analysis, ongoing support, ease of use, automated dispute generation, and pricing.

Choosing a reliable provider with strong security measures is crucial to protect personal and sensitive information.

While credit repair software cannot guarantee a higher credit score, it can help to speed up the dispute resolution process and give you more control and flexibility in your credit repair efforts.

Keep in mind that credit repair requires time, effort, and persistence. Results may take several months to become visible.

FAQ’s

Q. What is the top-rated credit repair software?

The top-rated credit repair software for consumers is The Personal Credit Builder, which costs $199.97-$400.00 and can import your three credit reports in a single click, create dispute letters, and track your progress.

For professionals, Credit Repair Cloud, which costs $179-$599 per month and can automate credit disputes, handle up to 300 clients, and provide support and training.

Q. Which credit repair software works best for improving credit scores?

The answer may depend on your personal situation and goals, but SmartCredit, which costs $29.95 per month and provides personalized action buttons for each negative item on your credit report, as well as a score simulator and identity theft protection, is one credit repair software that claims to focus on actions rather than disputes.

Q. Are there any affordable credit repair software options?

Yes, some credit repair software programs provide low-cost or free plans to consumers. Dovly, for example, offers a free plan that allows you to automatically file disputes and monitor your credit.

Credit Versio, which costs $19.95 per month and can generate dispute letters, track your results, and provide tips and advice, is another option.

Q. How do I choose the best credit repair software for my needs?

To choose the best credit repair software for your needs, you should consider several factors, such as:

- The budget and the amount of money you are willing to spend on software

- Your level of expertise and comfort with dealing with your own credit issues

- Expectations and the speed with which you want to see results

- Preferences and level of control over the process

- Characteristics and the services you seek, such as dispute letters, score tracking, identity theft protection, and so on.

Q. What features should I look for in credit repair software?

Some of the common features that you should look for in credit repair software are:

- Ease of use and user-friendliness

- Compatibility with all three major credit bureaus (Experian, Equifax, and TransUnion)

- Ability to import your credit reports and analyze them for errors

- Capability to write and send credit bureau and creditor dispute letters

- Tracking your progress and seeing changes in your score

- Access to customer service and guidance

- The ability to safeguard your personal information and identity

Q. Are there any credit repair software programs that offer a free trial?

- Yes, some credit repair software programs offer a free trial or a money-back guarantee for a limited time. For example, Credit Repair Magic offers a 60-day money-back guarantee if you are not satisfied with the results.

- Another example is ScoreCEO, which offers a free plan for up to 10 clients and a 14-day free trial for other plans.

Q. Can credit repair software help remove negative items from my report?

Yes, credit repair software can assist you in refuting negative items on your credit history with credit bureaus and creditors.

You should be aware, however, that not all negative items can be removed, particularly if they are accurate and verifiable.

Credit repair software can only assist you with incorrect, outdated, incomplete, or unverified information.

Q. Is it worth investing in credit repair software to fix my credit?

The answer depends on your personal situation and goals, but investing in credit repair software can be worthwhile if you have a lot of negative items on your report that are affecting your score and limiting your access to credit.

By automating the process of disputing errors and improving your credit score, credit repair software can help you save time and money.

You should be aware, however, that credit repair software is not a magic solution that will instantly improve your credit. You must maintain your fiscal responsibility and pay your bills on time.

Q. Are there any user reviews or testimonials for effective credit repair software?

Yes, there are numerous user reviews and testimonials for various credit repair software programs available online. They can be found on websites like [Trustpilot], [Sitejabber], [ConsumerAffairs], and [Better Business Bureau].

You can also look for reviews on social media sites like [Facebook], [Twitter], and [YouTube]. However, be cautious when reading user reviews and testimonials, as some of them may be biased or fabricated.

Q. Where can I find deals or discounts on the best credit repair software?

One way to find deals or discounts on credit repair software is to look for coupon codes or promo codes on websites such as [RetailMeNot], [Groupon], or [Couponzguru].

You can also look for seasonal offers or special deals on the official websites of the credit repair software programs. Another way to find deals or discounts is to contact the customer service of the credit repair software and ask if they have any current promotions or discounts available.

[…] 7 BEST Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] 7 BEST Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] See also 7+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] See also 7+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] See also 7+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] See also 7+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] Best Credit Repair Software Options: Turbocharge your Finances in 2023 […]

[…] Best Credit Repair Software Options: Turbocharge your Finances! (2023) […]

[…] 7+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] best AI software for video editing, marketing, recruiting, issue-tracking, and credit repair in recent articles. Let’s take a look at some of the best AI tools for business available today […]

[…] See also 9+ Best Credit Repair Software Options: Turbocharge Your Finances in 2023! […]

[…] seen the best AI software for video editing, marketing, recruiting, students, and credit repair in recent articles. Let’s take a look at some of the best AI sales tools available today in […]

[…] the best AI software for video editing, marketing, recruiting, students, business, sales, and credit repair in recent articles. Let’s take a look at some of the best AI celebrity voice generator available […]

[…] 💡 Related guide: Best Credit Repair Software Options: Turbocharge your finances (2023) […]